FII DII ACTIVITY FOR TODAY

Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII) data hold a significant role in market movement. FIIs are registered entities outside of the country while DIIs are investors or investment companies within the country. Daily Trends used for short-term traders to capture daily volatility.

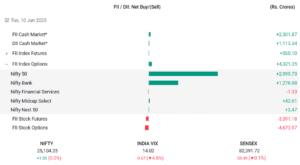

Today FIIs bought Rs.2301 cr. and DIIs bought Rs.1113 cr. in the cash market. Although a significant buying was done in Cash and Index options the NIFTY closed at 1.05 point which indicates an indecisive market.

Tomorrow Market Prediction For NIFTY

On 10th June 2025, After a gap up opening the Indian stock market ended sharply lower, with the benchmark Nifty 50 closing near previous day low i.e ,25104.

A long bearish candle was formed on the daily chart that signals a sharp downside trend in the market. Back-to-back two days bearish candle formation shows weakness, indicating sellers are back in charge.

NIFTY rejects from 25195 and engulfs the previous day candle with a big red candle forming engulfing pattern.

- If NIFTY opens flat near todays closing, Price may come upto its demand zone 25060 where it may try to move upward direction and price will comeback from resistance (Red) zone.

- If price crosses red zone, price may move upward direction upto 60 points

- If Price comes below the red line, then it may come near 25000 to fill the previous gap.

Click to Know Top Gainers and Losers of the day

Support Levels: 25061 and 25000

Resistance Level: 25150

Join Telegram for daily NIFTY analysis

Note:

- Mark the levels before trade

- We are not recommending for buying or selling

- This post is for educational purpose only

- Do not buy at resistance or Do not sell at support