As Digital payments and related scams are booming together, the India’s Capital market regulator SEBI is tightening digital security by introducing new verified UPI system to prevent Cyber frauds.

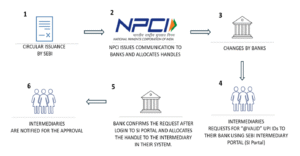

The Securities and Exchange Board of India (SEBI) has announced a new verified UPI mechanism for all registered intermediaries dealing with investor funds after consultations with the National Payments Corporation of India (NPCI) and other stakeholders aims to simplify fund transfers and ensure authenticity.

SEBI New UPI Mechanism for Investors and Market Intermediaries—Big News

The “Validated UPI Handles” and “SEBI Check” will enhance Investor Protection and combat cyber fruds.

Validated UPI Handles

- carrying the suffix “@valid” for intermediaries like brokers, investment advisors, research analysts, merchant bankers, and mutual funds to collect payments from investors

- UPI ID ending with “@valid” plus the bank’s name for every SEBI-registered intermediary

The prefix will include a readable identifier followed by a suffix indicating the intermediary’s category, like “.brk” for brokers or “.mf” for mutual funds and a special green thumbs-up icon will appear, which will indicate that the institution is legitimate.

SEBI is also developing a companion tool “SEBI Check”, which will allow users to cross-verify UPI IDs by entering them manually or scanning QR codes.

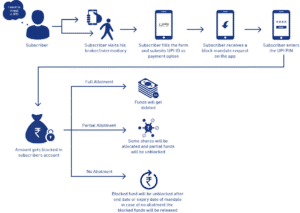

This new structured Unified Payments Interface (UPI) payment system, which comes into force from October 1, 2025 (Launch Date), Sebi chief Tuhin Kanta Pandey told in reports

“UPI, being a retail product, has certain transaction limits. Each app and bank impose its own limits; however, upper limits are set by NPCI. At present, this limit for capital market transactions is in the range of ₹2 lakhs–₹5lakhsper day,” said the SEBI.

FOR DAILY ANALYSIS OF NIFTY AND OTHER INDICES CLICK HERE

Conclusion:

- It is mandatory for all intermediaries to obtain these new UPI IDs

- The new UPI IDs are only for intermediaries to obtain and investors can continue to use their existing UPI IDs.

- The intermediaries will have to stop accepting payments using the current UPI IDs. the existing mode of fund transfer for the ongoing Mutual Funds SIPs will continue to remain in force to avoid any disruption, the new SIPs and renewal or extension of existing SIPs must be done using the new UPI IDs only.

- The allocation of the preferred user name will be subject to its availability.

- Yes, it is mandatory to generate a QR code with the “thumbs-up” logo for the convenience of investors, as scanning a QR code is more secure and reliable.

- The utility will allow the same username to be valid across different banks. However, it needs to be unique at a bank level.

- The UPI ID should properly show the name of the intermediary, followed by the short abbreviation of their category for example “brk” for Brokers, “mf” for Mutual Funds to the left of the “@” character.

- On the right side of the “@”, the new and exclusive handle “@valid” should be present, followed by the bank name.

- On the confirmation screen, the app should show a white thumbs-up icon inside a green triangle.

- The QR code generated using the utility will have a white thumbs-up icon inside a green triangle. It will also display the UPI ID just below the QR code.

- if my transaction/payment fails with the new UPI ID or any technical difficulty, investors are requested to approach their respective bank.

- It compulsory to use the provided utility for generating Username and new UPI ID

For More Info click it